ny highway use tax return instructions

You can also file now and schedule your electronic payment for a date no later. Quick guide on how to complete new york highway use tax return.

Ny Ifta 21 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

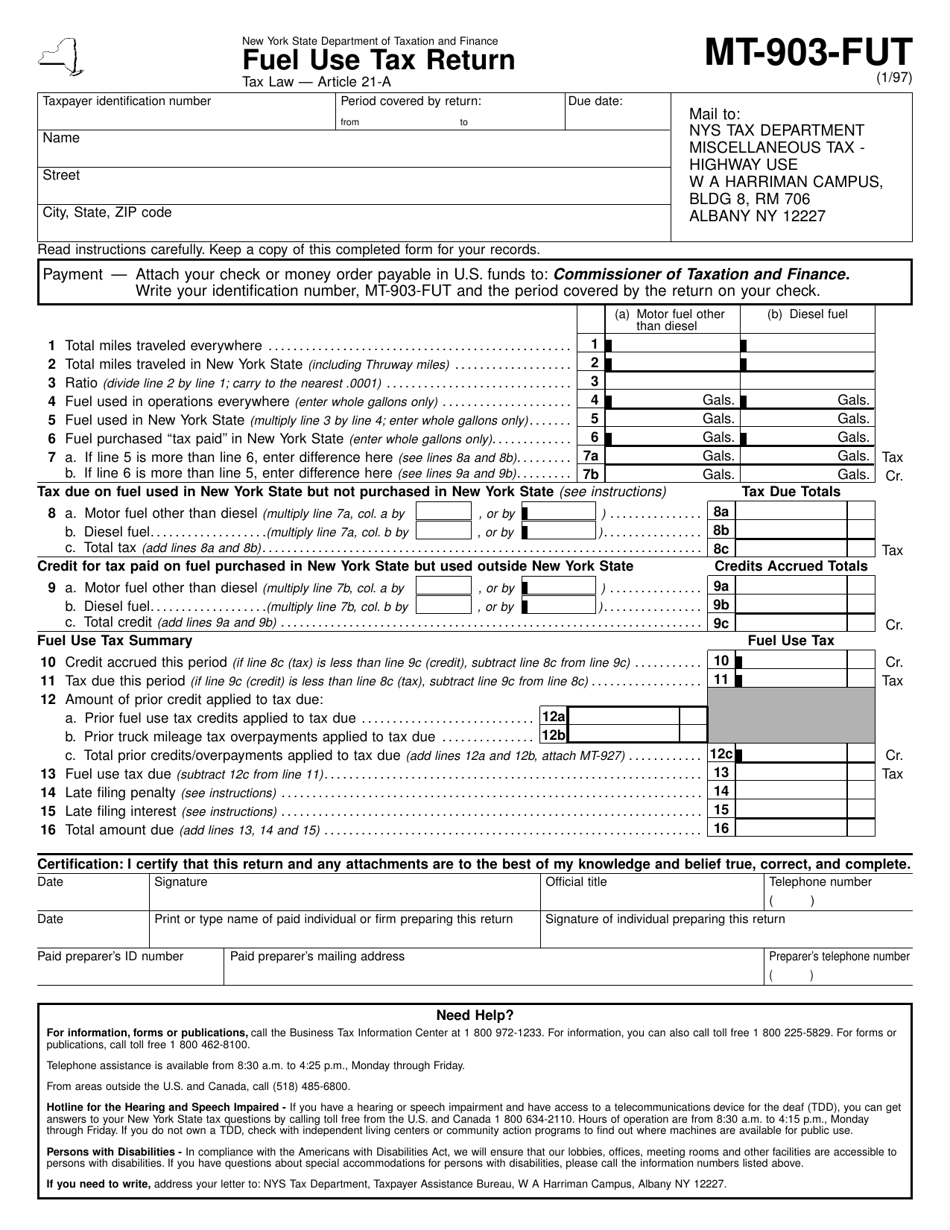

Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by buses or other.

. 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. Miles including New York State Thruway miles traveled in New York State for this period by all vehicles. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use tax add 1a and 1b 1a.

199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor.

Instructions for form 2290 heavy highway vehicle use tax return 0719 06152020 inst 2290. Highway Use Tax Web File You can only access this application through your Online Services account. Youll receive an electronic confirmation number with the date and time you filed your return.

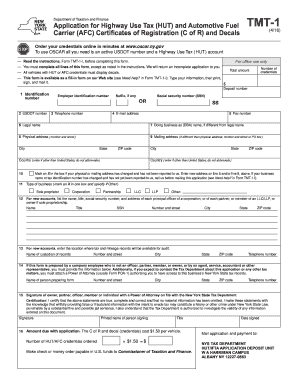

USDOT - Enter your USDOT Number. Forget about scanning and printing out forms. 18 rows Highway usefuel use tax IFTA Form number Instructions Form title.

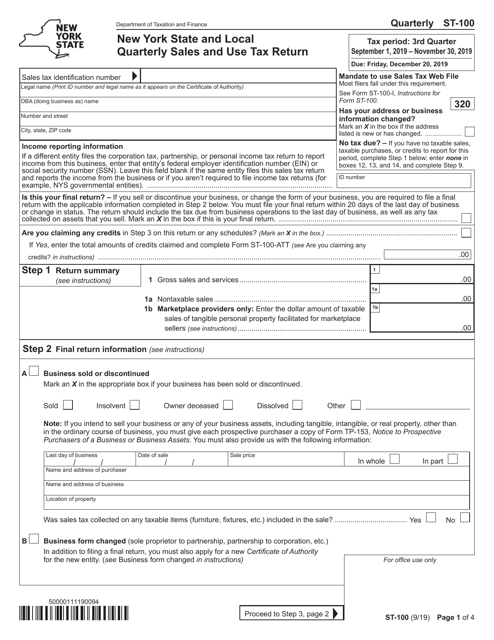

Thursday May 12 2022. New York State Department of Taxation and Finance. Use Form 2290 to.

Use our detailed instructions to fill out and eSign your documents online. Select the document you want to sign and click Upload. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out.

This publication is a guide to the New York State highway use tax and includes information regarding vehicles subject to tax registration requirements exemptions record keeping returns and special provisions. Manifest Form for Liquors. Figure and pay the tax due if.

Use Highway Use Tax Web File to report and pay. 1994 highway use tax. Figure and pay the tax due if.

Miles traveled in New York State for this period by all vehicles. Change of business information in the instructions. Alcoholic Beverages Tax Clearance Return for Tax on Importation of Alcoholic Beverages into New York State for Personal Consumption.

Do not report mileage traveled on the tollpaid portion of the New York State. Use our online JurisdictionRate Lookup by Address service to determine the applicable sales tax rate to be used on line 6 of Form MT-39. Highway Use Tax Web File You can only access this application through your Online Services account.

Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. For more information see TB-HU-260 Filing Requirements for Highway Use Tax.

Follow the step-by-step instructions below to eSign your form mt 903. Web File is FREE -- No additional software needed. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period.

The time to renew is over. Forms and instructions and to obtain information updates on New York State tax matters. Prior highway use tax overpayments to be applied attach a copy of Form MT-927.

Instructions for Form MT-903. Use Highway Use Tax Web File to report and pay highway use tax. Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by.

Highway Use Tax HUT Web File is the easiest and fastest way to file a highway use tax return and make a payment. SignNows web-based ddd is specifically designed to simplify the arrangement of workflow and optimize the whole process of proficient document management. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more.

This publication is a guide to the New York State highway use tax and includes information regarding vehicles subject to tax registration requirements exemptions record-keeping returns and special provisions related to automotive fuel carriers. It also includes information regarding the transportation of alcoholic beverages cigarettes tobacco products. Highway Use Tax Return - Taxnygov May 31 2016 - Form MT-903 Highway Use Tax Return.

Form MT-903 Highway Use Tax Return Revised 122. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. 24 rows Highway usefuel use tax IFTA Form number Instructions Form title.

Highway Use Tax Return. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use. Form MT-903 Highway Use Tax Return Revised 122.

Use Form 2290 to. Filing your highway use tax return. Ny highway use tax return instructions.

If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. Miles including New York State Thruway miles traveled in New York State for this period by all vehicles. New York State highway use tax TMT New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Fill Free Fillable Forms For New York State

Highway Use Tax Web File Demonstration Youtube

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Form Dtf 406 Claim For Highway Use Tax Hut Refund

Mt 903 I Fill Online Printable Fillable Blank Pdffiller

New York Hut Sticker Fill Out And Sign Printable Pdf Template Signnow

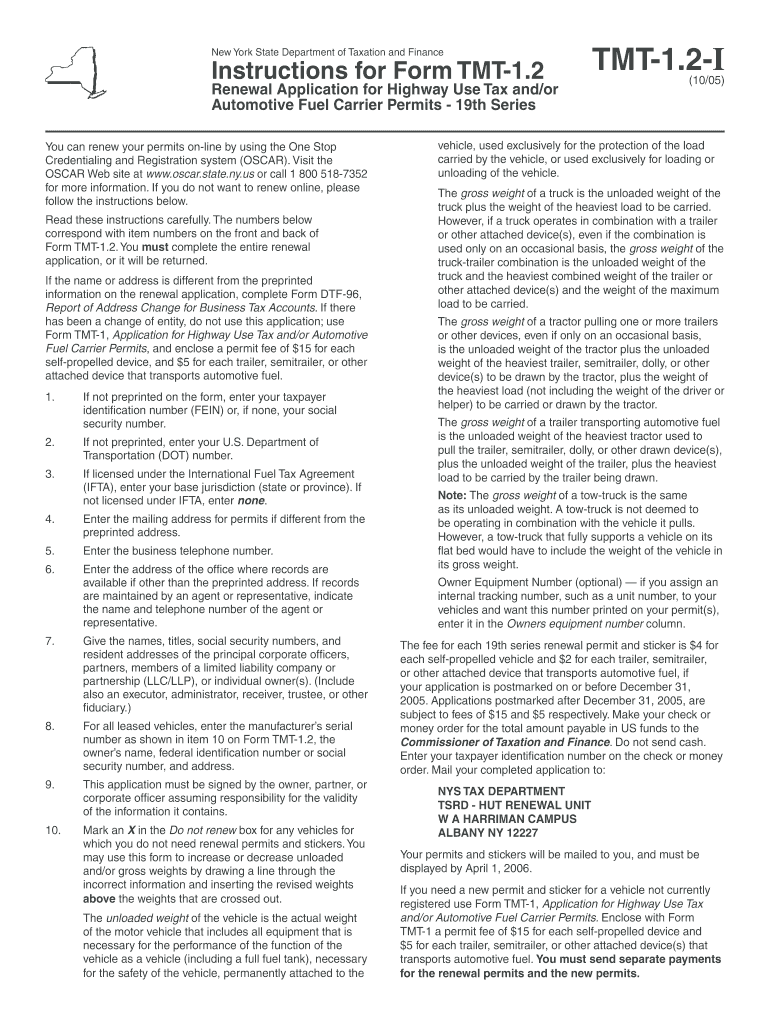

Ny Tmt 1 2 I 2005 2022 Fill Out Tax Template Online Us Legal Forms

Fill Free Fillable Forms For New York State

New York State Department Of Taxation And Finance Forms Pdf Templates Download Fill And Print For Free Templateroller

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Highway Use Tax 2290 800 498 9820

Form Mt 903 Fut Download Printable Pdf Or Fill Online Fuel Use Tax Return New York Templateroller

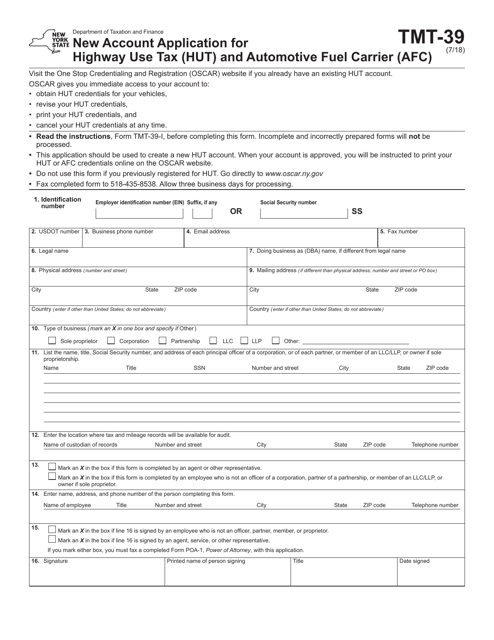

Form Tmt 39 Download Fillable Pdf Or Fill Online New Account Application For Highway Use Tax Hut And Automotive Fuel Carrier Afc New York Templateroller

Ny Highway Use Tax Hut Explained Youtube

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Form Tmt 2 9 V Fillable Payment Voucher For Highway Use Tax Hut And Automotive Fuel Carrier Afc Certificates Of Registration C Of R And Decals Renewed Electronically